nj property tax relief for seniors

The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes. It was established in 2000 and is an active part of the American Fair Credit.

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Happy Retirement Quotes

2020 92969 or less.

. About the Company Property Tax Relief For Nj Seniors. For mobile home owners the total of all property tax relief. In 2021 the average New Jersey property tax bill was about 9300.

Find Fresh Content Updated Daily For Nj property tax relief for seniors. Your total annual income combined if you were married or in a civil union and lived in the same home was. For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy.

1 day agoAdditionally you must have lived in New Jersey for the last 10 years either as a homeowner or a renter and your property tax payments must be up-to-date. CuraDebt is a debt relief company from Hollywood Florida. Ad No Money To Pay IRS Back Tax.

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. Property Tax Relief Forms. Of renter rebates would add more.

It was founded in 2000 and has since become a participant in the American. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled. Through the Tax Counseling for the Elderly TCE program IRS-trained volunteers assist individuals age 60 and over with their tax returns at various.

New Jerseys senior disabled and lower-income homeowners who receive credits on their property tax bills through the Homestead Benefit program would see additional. Amounts that you receive under the Senior Freeze program are in addition to the States other property tax relief programs. CuraDebt is a debt relief company from Hollywood Florida.

2021 94178 or less. You must be age 65 or older or disabled with a Physicians Certificate or Social Security document as of December 31 of the. About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the.

About the Company Nj Property Tax Relief For Seniors. Eligibility Requirements and Income Guidelines. Applications for the homeowner benefit are not available on this site for printing.

If you meet certain requirements you may have the right to claim a. Phil Murphys proposed property-tax relief plan is designed to relieve the burdens on poorest New Jersey homeowners and renters. A measure that easily cleared key committees in both houses of the Legislature would revise the states popular senior freeze property-tax relief program to make sure those.

For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the.

Documentation For Loan Against Property What You Need To Know Property Tax Tax Debt Relief Loan

Looking For A Cancellation Of Homestead Deduction The District Of Columbia Download It For Free

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

Property Tax How To Calculate Local Considerations

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Murphy Announces Details Of Property Tax Relief Program Whyy

Printform Finance Incoming Call Screenshot Property Tax

Property Tax Map Tax Foundation

2022 Property Taxes By State Report Propertyshark

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Real Property Tax Howard County

Property Taxes Property Tax Analysis Tax Foundation

How Taxes On Property Owned In Another State Work For 2022

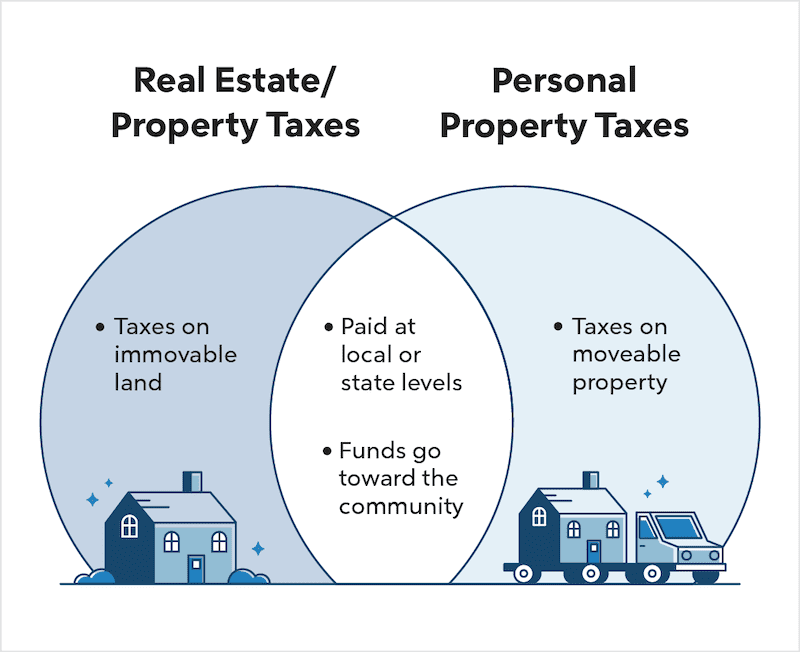

Real Estate Taxes Vs Property Taxes Quicken Loans

Nj Property Tax Relief Program Updates Access Wealth

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States

The Top 10 Most Taxed Cities In America Infographic Infographic Property Tax Family Income